Canadians generally pay nothing out-of-pocket for medically necessary services covered under their provincial or territorial health insurance plan. This includes doctor visits, hospital stays, and many diagnostic tests. However, some services aren’t covered, and wait times can vary.

Services Not Covered

Prescription drugs are a significant example. Provincial plans offer some coverage, often with age-related or income-based restrictions. Many Canadians supplement their coverage with private insurance plans purchased through their employers or directly. The cost varies dramatically based on the plan and the specific drugs needed. Dental care, Vision care, and Physiotherapy are frequently not covered or are only partially covered, leading to substantial out-of-pocket expenses. Expect to pay for these directly.

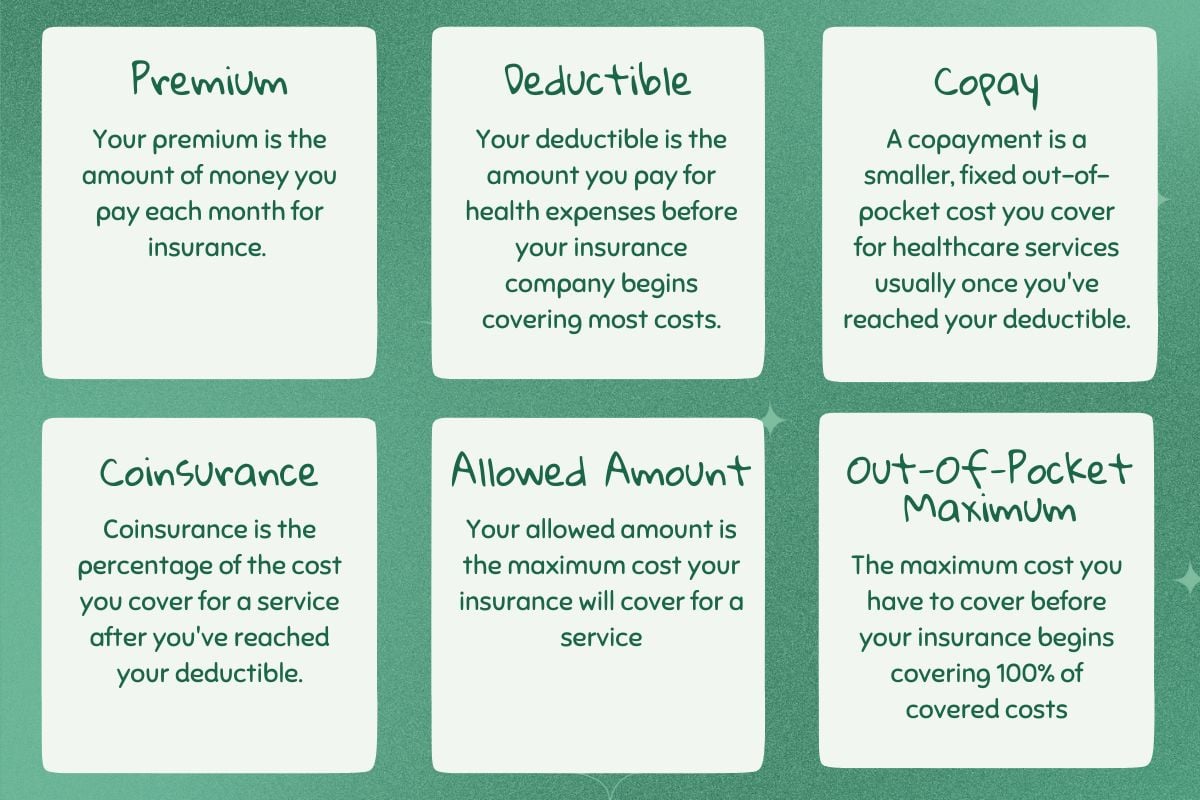

Understanding Your Coverage

Your provincial or territorial health insurance plan provides a basic level of coverage. Contact your provincial health authority for detailed information on specific services and associated costs. Private supplemental insurance can help reduce out-of-pocket expenses, especially for prescription drugs and services not covered under your public plan. Explore options offered through your employer or directly from private insurers. Carefully review policy details; coverage limits and exclusions vary significantly between plans.

Out-of-Pocket Costs

For services not covered by public or private insurance, expect costs to range widely. Factors such as location, the provider’s fees, and the complexity of the service will all influence the final bill. Getting cost estimates beforehand can help you budget accordingly. Many clinics and healthcare providers offer payment plans.